NACH (National Automated Clearing House)

Roles and Responsibilities of entities under NACH:

NPCI (National Payments Corporation of India)

NPCI provides NACH platform for the mandates registration and transactions. Mandate Management System is a service of NACH Debit which facilitates the process of Mandate Creation, Mandate Amendment, and Mandate Cancellation and offers all MIS related to the Mandate.

Corporates / User Institutions

Corporates wanting to avail NACH services need to register with NPCI & obtain Unique Identification Code (Utility Code) for NACH services through Sponsor Bank.

Customers

Customer submits NACH Mandate forms to the corporate/user institutions for debiting their accounts for repayment of Loan Instalment, SIP’s, Insurance Premiums, Credit card bills, Utility Bills like electricity charges, telecom, water etc.

Mandate

Customers are required to fill the mandate form with details like Name, account no, bank name, IFSC code, amount, tenure of transactions and submit the same to the corporate/ User institutions for registration.

UMRN

UMRN is a Unique Mandate Reference Number allocated to each new mandate created in system. It is auto generated by the NACH system during mandate creation. UMRN is mandatory for every transaction of mandate amendment and cancellation.

Sponsor Bank

Sponsor Bank is the Bank, which initiates NACH Transaction files for collection/ distribution of funds on behalf of its Corporates registered for NACH services. In case of loan EMI, the Bank acts as User Institution as well as Sponsor Bank.

Destination Bank

The Bank responsible for the processing of Inward NACH transaction file to effect debit / credit, to their customer accounts is known as Destination Bank.

Amendment to Mandate

Customers can modify the details registered for each Utility Code & UMRN in NACH by filling the Mandate form and opting to ‘Modify’. Customers can also opt to cancel NACH Mandates registered.

Withdrawal / Cancellation of Mandate

(i)Through Corporate/User Institutions:

All the Corporate /user institutions provide a facility of cancellation online on their website and through physical requests.

(ii)Through Destination Bank:

The account holder / customer is also entitled to withdraw the mandate / debit instruction from his / her banker without involvement of the User institution / the sponsor bank. The destination bank branches would accept request for withdrawal from customers and provide such withdrawal of mandate information based on confirmation from customer to the sponsor bank though NPCI. Sponsor banks will intimate the User Institutions of the cancellation of the mandate,

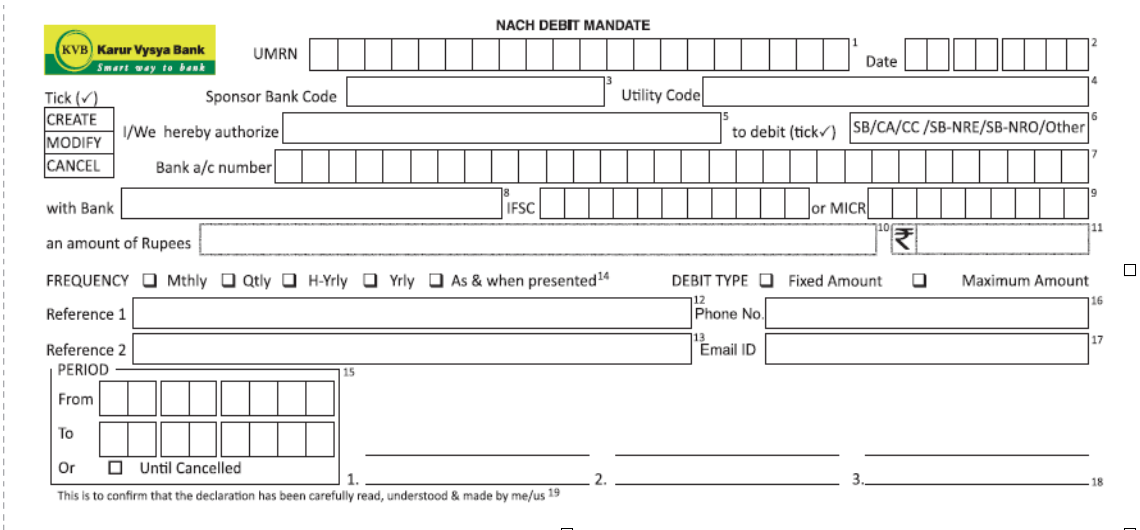

Mandate Form & Guidelines for filling NACH mandate:

| S.No | Field Name | Description | Mandatory |

| 1 | UMRN Unique Mandate Reference Number | This is a number allocated by NPCI on successful registration of a mandate. The customer can leave it blank. | No for new mandate. To be filled in case an existing mandate is cancelled / modified. |

| 2 | Date | Date on which the mandate is filled by the customer. This is similar to cheque date, and requires to be filled by the customer | Yes |

| 3 | Sponsor Bank Code | Sponsor Bank IFSC / MICR code | Yes |

| 4 | Utility Code | Corporate user code issued by NPCI | Yes |

| 5 | Box after “I/ We authorize” | Name of the corporate collecting the Payment. For example incase of payment towards Airtel Telephone bills, the box should contain “Airtel” | Yes |

| 6 | To Debit | Specifies the type of account to be debited at the destination bank (Eg : Savings, Current etc..) | Yes |

| 7 | Bank A/c Number | Specifies the account to be debited at the destination bank | Yes |

| 8 | With Bank | Name of the customer’s Bank where the above account is maintained | Yes |

| 9 | IFSC / MICR | IFSC or MICR code of the Bank where the customer maintains the account to be debited | Yes |

| 10 | Amount (in words) | The actual / maximum amount that is to be debited (in words) | Yes |

| 11 | Amount (in figures) | The actual / maximum amount that is to be debited (in figures) | Yes |

| 12 | Reference 1 | Additional Information | No |

| 13 | Reference 2 | Additional Information | No |

| 14 | Frequency | Defines on what periodicity the transaction has to be initiated by the sponsor Bank upon successful registration of the mandate. For eg, for EMI payment, the frequency will be monthly. For Electricity bill payment, the frequency will be “As and when presented” | Yes |

| Debit Type (Fixed Amount/ Maximum Amount) | Specifies whether the amount mentioned above is a fixed amount or the maximum amount up to which a single debit can be made in one transaction. For eg, “Fixed amount” will be for EMI payments. “Maximum Amount” will be in case of Telephone Bill payment / Electricity Bill payment etc, where monthly billing is not a fixed amount. | Yes | |

| 15 | Period | Defines the validity of the mandate as specified by the customer. The validity can be up to a certain date as specified by the customer or until cancellation of the mandate by the customer. | Yes |

| 16 | Phone No | Phone number of the customer | No |

| 17 | E-Mail ID | E-Mail ID of the customer | No |

| 18 | Signature and name of the account holders | Signature and name of the account holders as per the operating instruction of the account | Yes |